A new analysis of the Affordable Care Actfs health insurance marketplace

costs finds that, nationwide, marketplace premiums did not increase at all from

2014 to 2015, though there were substantial average premium increases in some

states and declines in others. This weighted analysis is the most comprehensive

to date as it examines:

The average premiums for the second lowest-cost silver plan—or benchmark plan

for calculating the federal subsidy in a given state—were also unchanged. And

the average deductible for a marketplace plan increased by just 1 percent year

to year.

The premiums presented are for a 40-year-old nonsmoker. Results are weighted

to reflect the population distribution across rating regions. The data for

single and family premiums are available in an interactive

map.

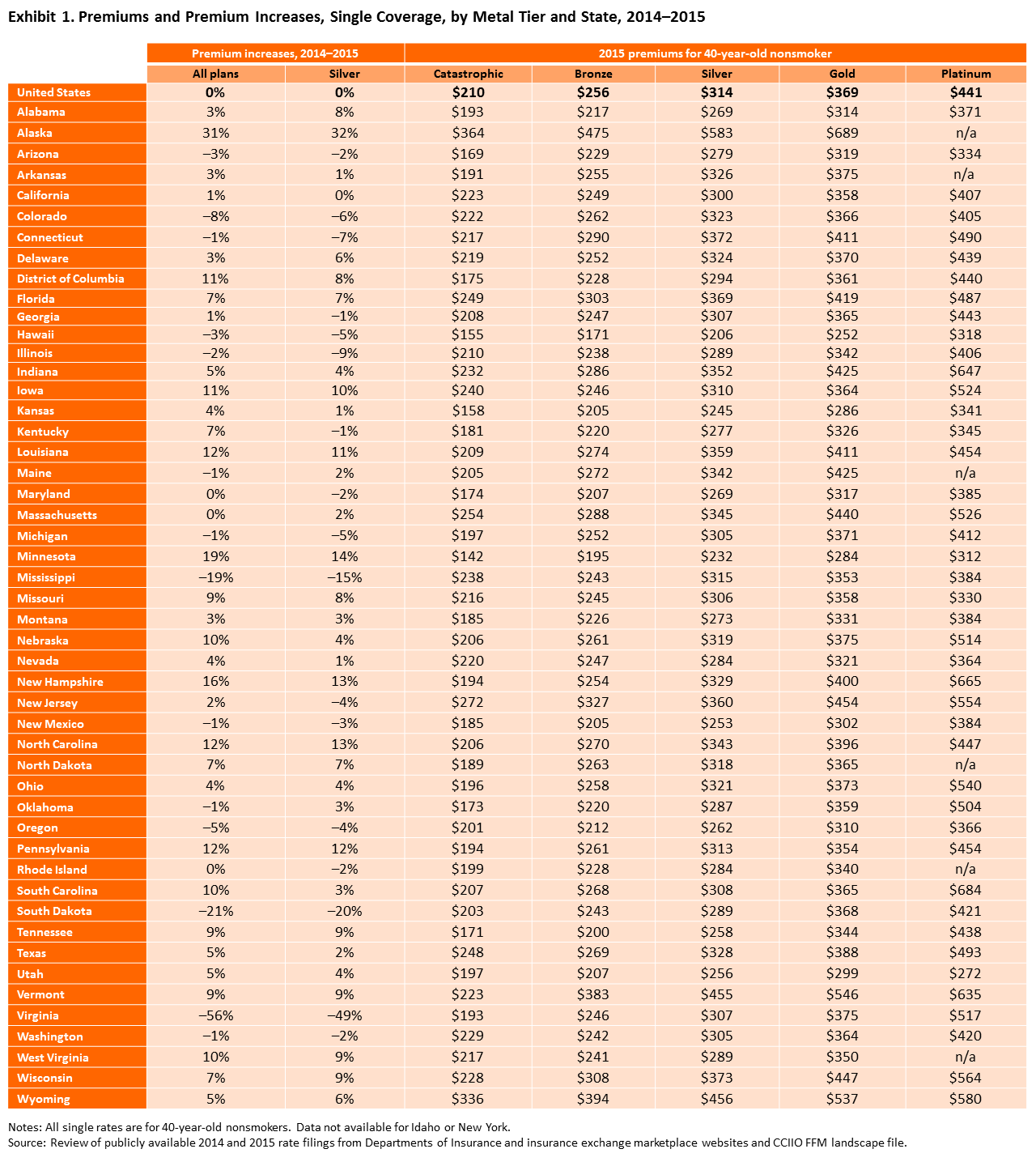

While average premiums nationwide did not change from 2014 to 2015, there

were wide differences across states (Exhibit 1). There were double-digit

increases in 10 states plus the District of Columbia (Alaska, the District of

Columbia, Iowa, Louisiana, Minnesota, Nebraska, New Hampshire, North Carolina,

Pennsylvania, South Carolina, and West Virginia). Average premiums declined in

14 states (Arizona, Colorado, Connecticut, Hawaii, Illinois, Maine, Michigan,

Mississippi, New Mexico, Oklahoma, Oregon, South Dakota, Virginia, and

Washington).

In certain states, those double-digit increases and decreases can be tied to

a single insurer decision. In Minnesota, the state with the lowest premiums

nationally in 2014, PreferredOne—the carrier with the lowest statewide premiums

and largest market share—exited the market, driving up the average cost of a

marketplace plan. In Virginia, Optima Health, a carrier charging $2,000 a month

for a silver plan, a figure nearly seven times the cost of the

average silver plan, dropped this expensive plan, thereby sharply decreasing the

average cost for plans in Virginia.

In other states, entry by multiple carriers enhanced price competition, which

made shopping around a good approach for consumers in the second enrollment

period. In Georgia, Cigna, Coventry, United Healthcare, and Time Insurance

entered the market, and the benchmark silver plan increased by 1 percent in the

state. In Michigan, UnitedHealth Care, Physicians Health Plan, and Harbor Health

Plan entered the market, and the average cost of all plans fell by 1

percent.

For silver plans, which accounted for 65

percent of 2014 enrollment nationwide, the average premium was unchanged

from 2014 to 2015. Seven states had double-digit increases in silver plan

average premiums (Alaska, Iowa, Louisiana, Minnesota, New Hampshire, North

Carolina, and Pennsylvania). By contrast, the average silver plan premium

decreased in 17 states (Arizona, Colorado, Connecticut, Georgia, Hawaii,

Illinois, Kentucky, Maryland, Michigan, Mississippi, New Jersey, New Mexico,

Oregon, Rhode Island, South Dakota, Virginia, and Washington).

Average 2015 monthly premiums nationwide are:

- bronze plan—$256

- silver plan—$314

- gold plan—$369

- platinum plan—$441.

The state with the lowest average premiums for silver plans is Hawaii ($206)

while Alaska had the highest average premiums ($583).

Changes in Benchmark Silver Plans

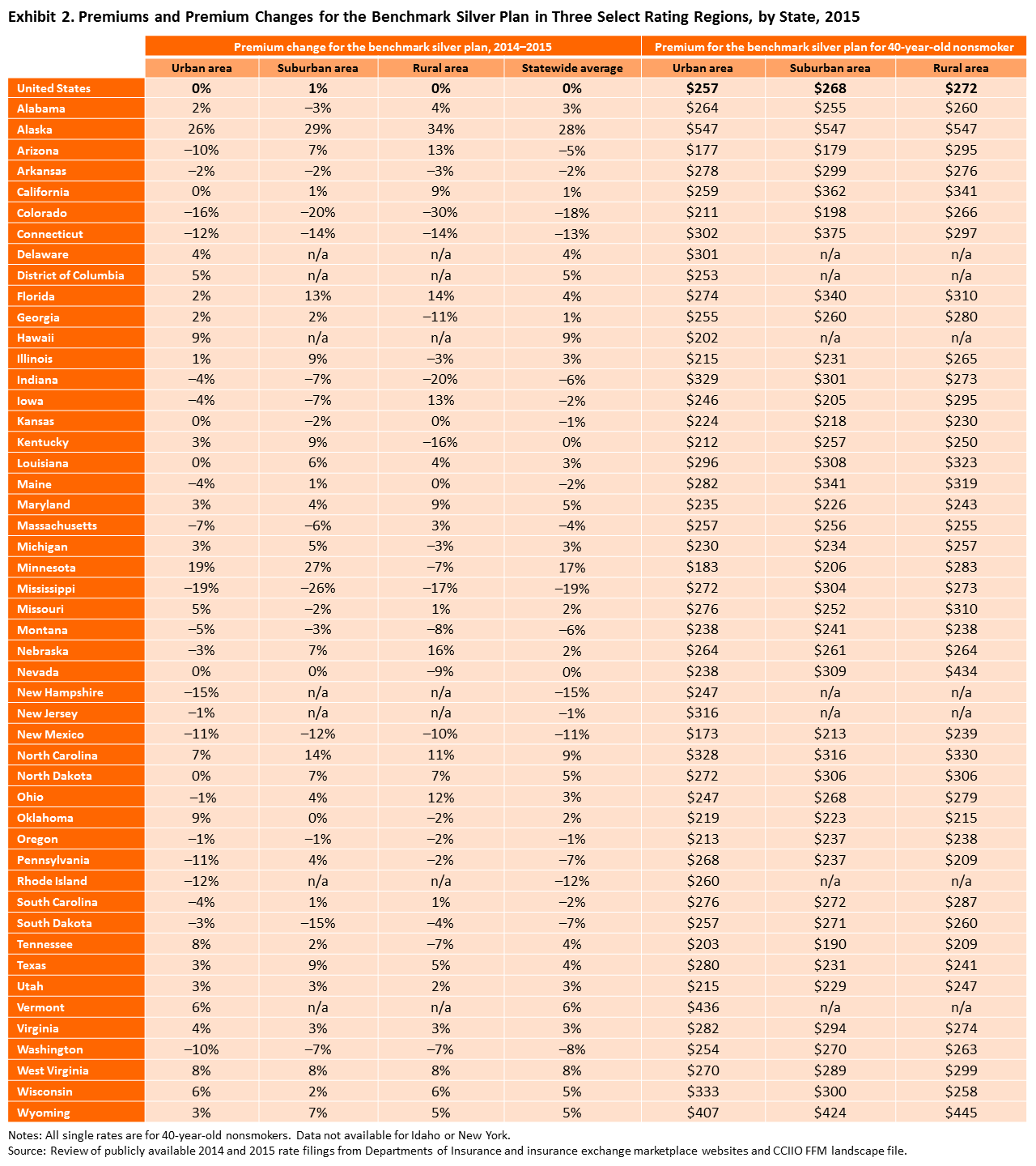

From 2014 to 2015, the nationwide average of premiums for the benchmark plans

was also unchanged (Exhibit 2). While two states, Alaska and Minnesota, had

double-digit increases in the cost of the benchmark plans, many more states saw

decreases. Premiums for the benchmark plan declined in 20 states, with six

states having double-digit decreases (Colorado, Connecticut, Mississippi, New

Hampshire, New Mexico, and Rhode Island).

Urban, suburban, and rural rating regions experienced similar premium

changes. Nationally, the average cost of a benchmark silver plan in 2015 is $257

in urban areas, $268 in suburban areas, and $272 in rural areas.

Changes in Deductibles

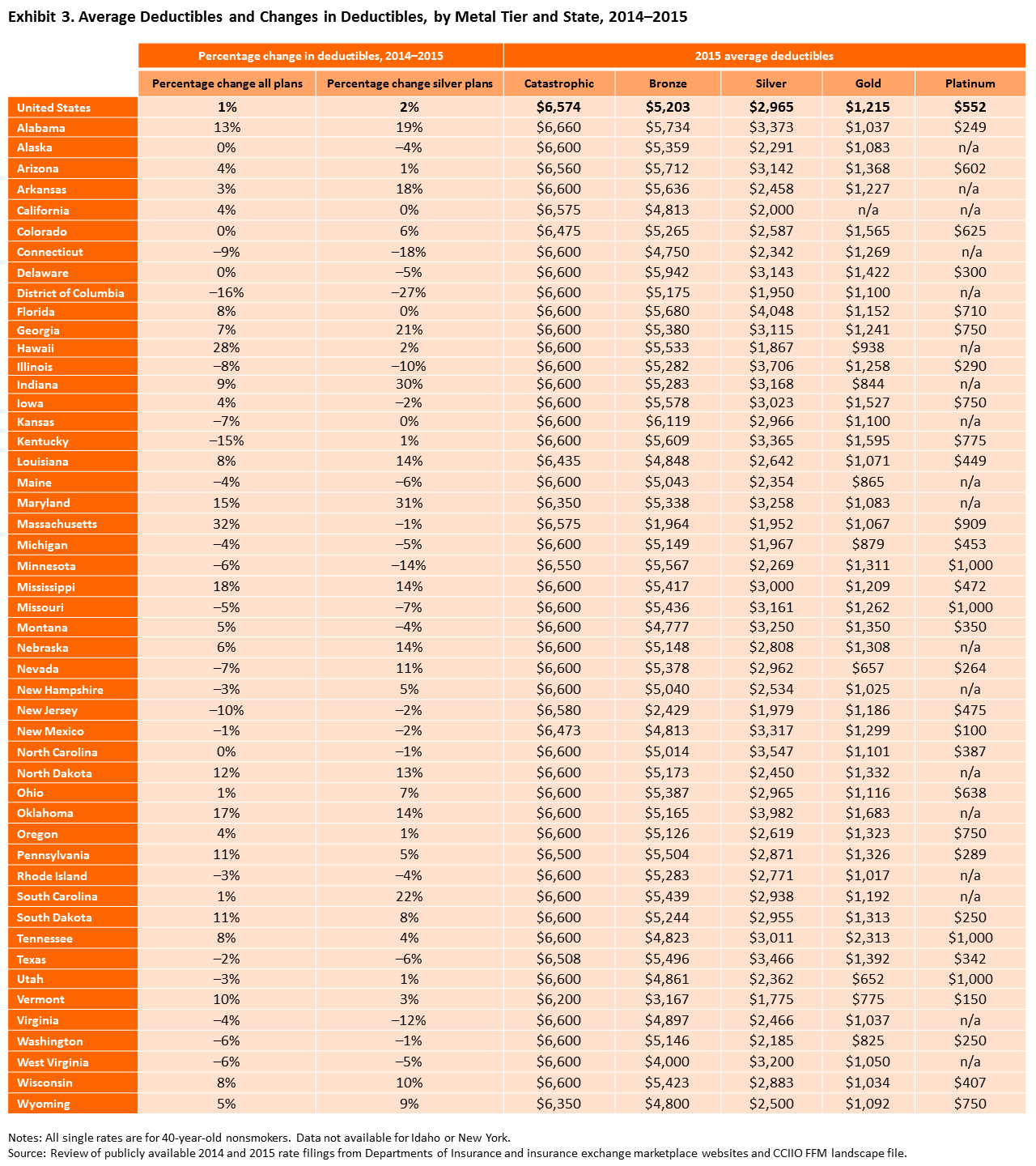

Nationally, average deductibles increased by 1 percent from 2014 to 2015,

though, again, changes in deductibles varied considerably from state to state

(Exhibit 3). Slightly more states saw increases than decreases (26 states versus

19). Massachusetts and Hawaii had the highest rates of increase in the average

deductibles, at 32 percent and 28 percent, respectively. Washington, D.C.,

residents saw the greatest decrease—with average deductibles down by 16 percent.

In 2015, bronze plans have average deductibles of $5,203; silver plans, $2,965;

gold plans, $1,215; and platinum plans, $552.

Among silver plans, average deductibles increased in 26 states and declined

in 20 states. The changes ranged from increases of 31 percent and 30 percent

(Maryland and Indiana, respectively) to a decrease of 27 percent (Washington,

D.C.). There is substantial variation among states in average deductibles among

silver plans, ranging from $4,048 in Florida to $1,775 in Vermont. Much of this

variation is because of other aspects of the benefit package, such as copayment

or coinsurance levels.

Carrier Participation

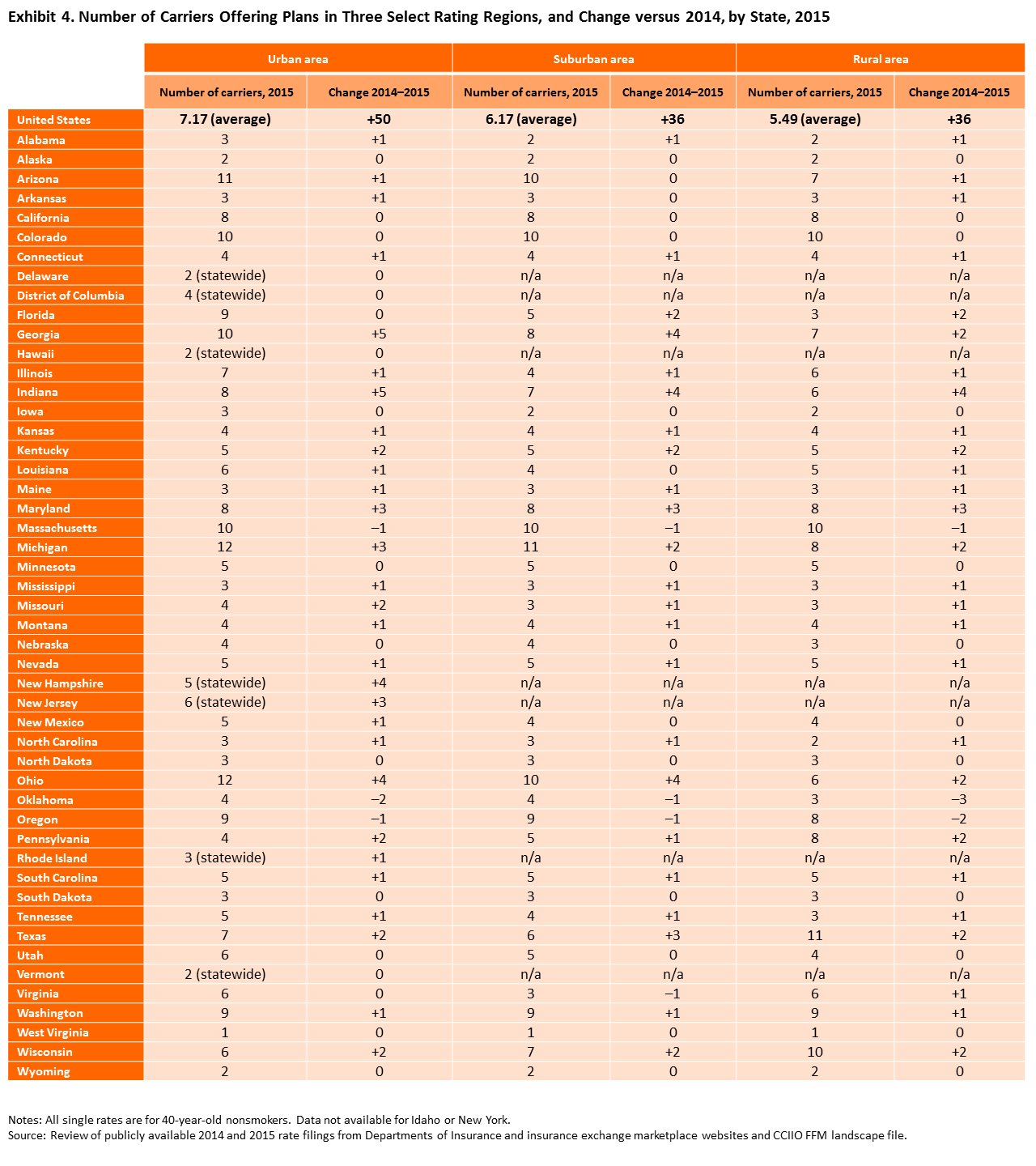

The number of plans offered nationwide increased by 25 percent (not shown).

Fifty more carriers offered plans in urban areas—an average of one additional

carrier per state in 2015 (Exhibit 4). Georgia, Indiana, New Hampshire, and Ohio

saw the largest increase in the number of participating carriers. Increases were

seen across all types of geographical areas. For the selected urban rating

regions, 29 states had increases in the number of participating carriers, while

just three had a decrease, and 17 states experienced no change in the number of

carriers. For the selected suburban areas, 23 states had an increase in the

number of participating carriers, and only four had a decrease. For selected

rural rating regions, 27 had increases and three had decreases.

City dwellers have a few more health plan options than their counterparts in

suburban and rural areas. Nationwide, the average number of carriers

participating in urban rating regions is 7.17, versus 6.17 in suburban and 5.49

in rural rating regions.

Behind the Numbers

Why are marketplace insurance costs stable at a national level? One factor is

the way the Affordable Care Act structured the marketplaces. Greater

standardization of benefits through the metal tier structure, premium and

cost-sharing subsidies that are tied to the silver plans, the transparency of

plan information, and robust enrollment in 2014 are collectively increasing the

competitiveness of the market. Sixty-four percent of enrollees in 2014 chose the lowest or

second-lowest cost plan in their tier.

In addition, the risk stabilization programs, which include risk adjustment,

risk corridors, and reinsurance, diminish insurersf risk of financial losses and

allow them to price their plans more aggressively. The temporary risk corridor

program limits both gains and losses of insurers participating in the

marketplace and the temporary reinsurance program provides stop-loss coverage

when claims expenses for an individual exceed a specified amount. The permanent

risk adjustment program transfers funds from insurers with lower-risk patients

to those with higher-risk patients.

The appeal of the marketplace structure and risk stabilization programs have,

in turn, led to the increase in insurer participation, which also helps to

contain costs.

An outstanding question, however, is the long-term sustainability of current

trends in premiums. Similar to employer-based insurance, long-run developments

in marketplace premiums will follow trends in medical claims expenses per

capita. With the exception of the mid-1990s, the era of restrictive managed

care, claims expenses have historically increased at 5 percent or more per year

(see Appendix). Future price increases of marketplace plans will depend on how

effectively America reforms the delivery of care and moves from a system that

rewards high volume to one that rewards high-quality care.

See the appendix for the study methodology.